Swipe in Style With These 7 Best Metal Credit Cards

Alex: The other day I was at dinner with friends, and when the bill arrived, a buddy of mine offered to pick up the tab. While this was very generous of them, what really turned heads is when they dropped their thick metal credit card on the card tray, making a loud thump.

Metal cards aren’t new to miles and points enthusiasts, but they still often get attention when you use them because they’re so unusual. And while we don’t recommend applying for a card just because it’s metal, they sure can add a little flash to your wallet!

A Metal Card Like the Chase Sapphire Reserve Doesn’t Just Look Cool. It’s Also Got a Terrific Welcome Bonus and Ongoing Benefits!

A Metal Card Like the Chase Sapphire Reserve Doesn’t Just Look Cool. It’s Also Got a Terrific Welcome Bonus and Ongoing Benefits!

Here are some of our favorite metal credit cards, which are also great for earning miles, points, or cash back!

Introducing the Best Metal Credit CardsBanks are always looking for new ways to attract customers. And metal cards seem to have a “WOW” factor plastic cards just don’t have.

Million Mile Secrets team member Scott still gets many remarks from people impressed by his Chase Sapphire Preferred card when he hands it to them for purchases. Plus friends and family can get metal card envy when they see the hard shiny metal card in your wallet. Don’t worry, that’s not actually the reason Scott’s kept the card for over 4 years!

Via MarketWatch, some card companies use metal cards because folks are more likely to reach for the thick metal card in their wallet before other plastic cards. Metal cards are more expensive to produce, but also much more durable than plastic cards. So if you’re like me and wear out plastic cards quickly, a metal card could come in handy.

1. Chase Sapphire PreferredLink: Chase Sapphire Preferred

Link: Our Review of the Chase Sapphire Preferred

Many of us on the Million Mile Secrets team started out with the Chase Sapphire Preferred, and it’s still our pick for #1 best first credit card in our hobby. Not only does it look slick, with a shiny blue metallic finish, but also offers incredible value and flexibility.

With the Chase Sapphire Preferred, you’ll earn 50,000 Chase Ultimate Rewards points when you spend $4,000 on purchases in the first 3 months of account opening. That’s worth $625 in travel when you redeem points for travel through the Chase Ultimate Rewards travel portal.

Plus, you’ll get:

5,000 Chase Ultimate Rewards points for adding the first authorized user and making a purchase within the first 3 months 2X Chase Ultimate Rewards points per $1 spent on travel and dining at restaurants 1X Chase Ultimate Rewards Points per $1 spent on all other purchases NO foreign transaction fees Primary car rental insurance – Covers damage due to theft or collision to your rental car, when you pay for the rental with your card Trip delay reimbursement – Get up to $500 back per ticket when your trip is delayed more than 12 hoursThe $95 annual fee is waived for the first year. So it’s free to try out the card for ~11 months and see how you like it!

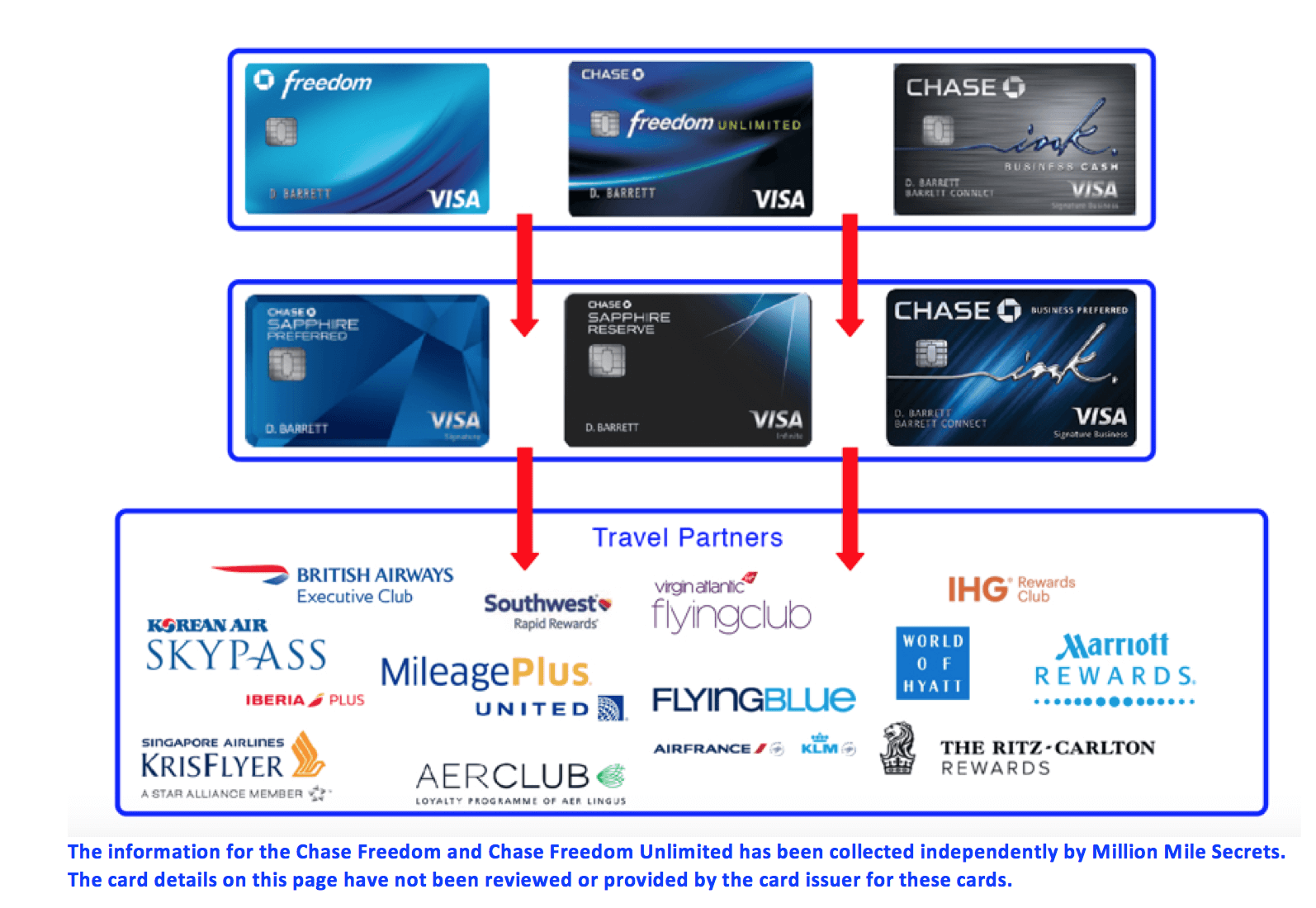

You’ll get potentially much more value for your points when you transfer points to travel partners like Hyatt or United Airlines.

|

Million Mile Secrets team member Jasmin’s children refer to the Chase Sapphire Preferred as the “fancy” blue card. So it even impresses kids!

Choose this card: If you’re new to miles and points, and are looking for your first travel credit card.

2. Capital One® Venture® RewardsLink: Capital One Venture Rewards

Link: Our Review of the Capital One Venture Rewards

The metal Capital One Venture Rewards card is designed for travelers who like to earn and redeem miles without complicated category spending or redemption requirements. And there are plenty of options for redeeming Venture miles, like hotels (even boutique hotels), flights, trains, cruises, Airbnbs, Uber rides, and more.

The Capital One Venture sign-up bonus is 50,000 Venture miles after you spend $3,000 on purchases in the first 3 months of opening your account. You’ll also get:

2 Venture miles per $1 you spend on all purchases 10 Venture miles per $1 you spend on hotel stays booked through this Hotels.com link (through January 31, 2020) NO foreign transaction fees Visa Signature benefits — including secondary rental car insurance, travel accident insurance, and lost luggage insurance.There’s a $95 annual fee, but it’s waived the first year.

You can redeem your Venture miles at a rate of 1 cent per mile towards travel. So the sign-up bonus is worth $500. But you can NOT transfer Venture miles to airline and hotel partners.

To redeem Venture miles for travel, use your Capital One Venture card to pay for your travel purchase. Once it’s posted to your account, you can “erase” the cost with miles. However, you must redeem the miles within 90 days of your purchase.

Redeem Capital One Venture Miles for Train Tickets on Amtrak

Redeem Capital One Venture Miles for Train Tickets on Amtrak

The Capital One Venture is actually a bit heavier than the Chase Sapphire Preferred, and has a silver metallic finish.

Need some help deciding? Check out our post about the Capital One Venture vs Chase Sapphire Preferred.

Choose this card: If you want a simple rewards program and miles that are easy to redeem.

3. Chase Sapphire ReserveLink: Chase Sapphire Reserve

Link: Our Review of the Chase Sapphire Reserve

If you spend a lot on travel and dining and enjoy airport lounges, the Chase Sapphire Reserve is a good pick. In fact, we rate it the top Premium travel credit card! Just like the Sapphire Preferred, this one is also made of metal with a deeper blue / black design, making it feel like a really exclusive card.

When you sign-up for the the Chase Sapphire Reserve card, you’ll earn 50,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening.

You’ll also get:

3X Chase Ultimate Rewards points on travel & dining worldwide 1X Chase Ultimate Rewards point on all other purchases $300 annual credit every cardmember anniversary for travel purchases such as airfare and hotels $100 statement credit for Global Entry Free Priority Pass Select membership for access to airport lounges No foreign transaction fees Visa Infinite benefits like $25 food and beverage credit at the Luxury Hotel Collection and complimentary car rental elite status with Silvercar Rental car discounts with National Car Rental and Avis If You Dine Out a Lot, Use the Chase Sapphire Reserve to Earn 3X Chase Ultimate Rewards Points per $1 at Restaurants, Even Overseas

If You Dine Out a Lot, Use the Chase Sapphire Reserve to Earn 3X Chase Ultimate Rewards Points per $1 at Restaurants, Even Overseas

The $450 annual fee is NOT waived the first year. The sign-up bonus is worth $750 in free travel, plus you’ll get up to $300 in annual credit for travel purchases. So you’ll get a total value of $1,050 in travel in the first year. And going forward, the annual travel credit, airport lounge access, and other perks can more than offset the annual fee.

Choose this card: If you travel frequently and spend a lot on travel and dining, especially abroad.

4. Chase Marriott Rewards Premier PlusLink: Marriott Rewards® Premier Plus Credit Card

Link: Our Review of the Chase Marriott Rewards Premier Plus

The Chase Marriott Rewards Premier Plus card, like its predecessor the Chase Marriott Rewards Premier (no longer available), is a heavy, black metal card. The card is so new none of us have tried it out yet, so we’re not sure if it’s heavier or the same weight.

This is a good card to consider if you stay at Marriott or Starwood hotels. You’ll earn 100,000 Marriott points after spending $5,000 on purchases in your first 3 months from account opening. Plus, you’ll get:

Free Night Award (at hotels costing 35,000 Marriott points or less) every year after your account anniversary Earn 6 Marriott points per $1 spent at participating Marriott Rewards & Starwood hotels Earn 2 Marriott points per $1 spent on all other purchases Automatic Silver Elite Status (20% bonus points on paid stays, late check-out when available) Gold Elite Status (25% bonus points on paid stays, lounge access / free breakfast, guaranteed late check-out, room upgrades when available) when you spend $35,000 on purchases each account year Coming in 2019, 15 elite night credits each calendar year NO foreign transaction feesThe card’s $95 annual fee is NOT waived the first year.

Escape to the Tropics! Use Marriott Points to Stay at the Aruba Marriott Resort and Stellaris Casino

Escape to the Tropics! Use Marriott Points to Stay at the Aruba Marriott Resort and Stellaris Casino

Team member Joseph keeps his Marriott card year after year for the free anniversary night award, which more than offsets the annual fee cost.

5. AMEX Business Platinum CardLink: The Business Platinum® Card from American Express

Link: Our Review of AMEX Business Platinum

The most frequent travelers can take advantage of huge rewards with the AMEX Business Platinum Card, which also sports a beautiful metal design. While the $450 annual fee (NOT waived first year) scares some people away, remember that frequent travelers can more than earn back the annual fee through the value and perks that it includes.

The AMEX Business Platinum comes with a 75,000 AMEX Membership Rewards point welcome bonus after meeting tiered minimum spending requirements within the first 3 months.

You’ll earn:

50,000 AMEX Membership Rewards points after you spend $10,000 on purchases in the first 3 months of account opening. 25,000 AMEX Membership Rewards points after you spend an additional $10,000 on qualifying purchases within the same timeframeMore benefits include:

1.5X AMEX Membership Rewards points on single purchases of $5,000+ 5X AMEX Membership Rewards points when you book airfare and hotels through the AMEX travel portal 35% of your points back for ALL First Class or Business Class flights booked through the AMEX travel portal using Pay With Points 35% of your points back for all flights, including coach tickets, booked with your selected airline through the AMEX travel portal using Pay With Points Up to $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, in-flight food & drink, etc.) Ability to book hotel stays through AMEX Fine Hotels & Resorts AMEX Premium Roadside Assistance Access to airport lounges (Delta, Priority Pass, Airspace, and American Express Centurion Lounges) Bonus points or statement credits when taking advantage of an AMEX Offer Elite car rental status with Avis, Executive status with National Car Rental, and Gold Plus Rewards with Hertz Free Hilton HHonors Gold elite status (free breakfast and upgrades when available) Free Starwood Gold elite status, which you can use to instantly match to Marriott Gold elite status 10 free Gogo in-flight Wi-Fi passes each calendar year Statement credit for Global Entry or TSA PreCheck Terms & limitations apply Use the Complimentary Hilton Gold Status From the AMEX Business Platinum to Get Free Breakfast at Hotels Like the Conrad Tokyo

Use the Complimentary Hilton Gold Status From the AMEX Business Platinum to Get Free Breakfast at Hotels Like the Conrad Tokyo

The AMEX Business Platinum Card is a small business card. But don’t dismiss it, because it’s easier than you might realize to qualify for a business credit card.

Plus, AMEX business credit cards do not appear on your personal credit report! So they’re useful if you want to stay under the Chase “5/24” rule.

Keep in mind, this is a charge card. So you’ll have to pay your balance in full every month, which we recommend anyway. Because paying interest can negate the value of any rewards you earn.

Choose this card: If you run a small business and you travel frequently.

6. AMEX Platinum CardLink: The Platinum Card from American Express

Link: Our Review of the AMEX Platinum

The AMEX Platinum card is designed for frequent travelers, especially those who appreciate lounge access. This card has been around for a long time as a plastic card, but in 2017 the design was refreshed and with it, came a change to a thick metal card design.

Remember that this is a charge card, like the AMEX Business Platinum Card. So you’ll have to pay the balance in full each month.

With The Platinum Card® from American Express, you can earn 60,000 AMEX Membership Rewards points after spending $5,000 on purchases within the first 3 months of opening your account. You’ll also get:

5X AMEX Membership Rewards points per $1 spent on airline tickets purchased directly with airlines or with American Express Travel, and on hotels booked on the AMEX Travel Portal $200 annual airline incidental fee credit $200 in Uber credit per year (but there are restrictions) Airport lounge access to Priority Pass, Centurion, and AirSpace Lounges Statement credit every 5 years after you apply for Global Entry ($100) or TSA PreCheck ($85) Hotel elite status with Hilton, Marriott, and Starwood Terms applyThe $550 annual fee is NOT waived the first year. But if you can make the most of the airline incidental fee credit, Uber credit, and perks like airport lounge access, you can more than make up for it.

AMEX Platinum Cardholders Can Enjoy a VIP Experience in Top Notch Airport Lounges, Like the Centurion Lounge in Houston

AMEX Platinum Cardholders Can Enjoy a VIP Experience in Top Notch Airport Lounges, Like the Centurion Lounge in Houston

When looking at the AMEX Platinum card, be sure to compare it to the AMEX Business Platinum card listed above. If you qualify for both, keep in mind the business version of this card offers a lower annual fee ($450 vs $550) AND a larger welcome bonus.

However, the spending requirements for the business version is also much higher than this one. So consider your spending habits as well!

Either way, you’ll score a beautiful metal card!

Choose this card: If you are a frequent traveler and enjoy luxurious airport lounges.

6. Chase Amazon Prime RewardsLink: Amazon Prime Rewards

Link: Our Review of Amazon Prime Rewards

If you spend a lot at Amazon or Whole Foods and are looking for a metal card, the Amazon Prime Rewards card is an interesting pick. It recently got an overhaul with a beautiful brushed metal design. And it’s a great option if you want a metal credit card with no annual fee.

You’ll earn a $70 Amazon gift card upon credit card approval (no minimum spending required). This isn’t a terrific sign-up bonus, but if you like cash back and spend frequently in the bonus categories, it’s worth checking out.

The card comes with:

5% back on Amazon or Whole Foods purchases if you have an Amazon Prime membership (otherwise 3% back) 2% back on gas stations, restaurants, and drugstores 1% back on everything else No limits to how much you can earn NO annual fee Amazon Shoppers Can Earn Big Cash Back With the Chase Amazon Prime Card – With NO Annual Fee

Amazon Shoppers Can Earn Big Cash Back With the Chase Amazon Prime Card – With NO Annual Fee

You can use your rewards at checkout directly on Amazon.com, or redeem for an account statement credit or electronic deposit. If you are a heavy user of Amazon and / or Whole Foods, you can earn serious cash back with this metal credit card, all without worrying about an annual fee.

Choose this card: If you are an Amazon Prime subscriber and want a metal card with no annual fee.

Wait … How Do You Dispose of a Metal Credit Card?While metal credit cards have their perks, including increased durability, this can be a hassle when it comes time to dispose of the card.

Do NOT try to shred your metal credit card (unless you’re in the market for a new shredder)! Instead, contact the bank and ask them how to dispose of the card. Most companies who issue these metal cards have procedures to help you with the process.

Give the Bank a Call for Assistance in Disposing of Your Metal Credit Card

Give the Bank a Call for Assistance in Disposing of Your Metal Credit Card

Chase, for example, has the process down very smooth. Simply call up the customer service number on the back of the card, and let them know that you want to dispose of the it. Chase will send you a package in the mail with return postage attached, which you can use to return the card. Once they receive it, they will dispose of it properly.

Bottom LineMetal credit cards get a lot of attention! While they have a certain “wow” factor, we don’t recommend getting a card just because it’s metal.

That said, there are plenty of metal credit cards you might consider for their excellent welcome bonuses, bonus spending categories, or ongoing travel perks like lounge access. Here are some of our favorites:

Best metal credit card for beginners to miles and points – Chase Sapphire Preferred Best metal credit card if you prefer easy rewards to earn and redeem – Capital One Venture Best metal credit card for frequent travelers – Chase Sapphire Reserve Best metal hotel credit card – Marriott Rewards® Premier Plus Credit Card Best metal credit card for small business owners – The Business Platinum® Card from American Express OPEN Best metal credit card for airport lounge access – The Platinum Card® from American Express Best metal credit card if you want a no-annual-fee card – Chase Amazon Prime RewardsThese aren’t the only metal cards on the market. So let us know if we missed your favorite!