It’s Electric! How I Earned 180,985 Points Purchasing a ~$60,000 Tesla With a Credit Card!

Keith: Last week, I made the largest purchase of my life – a brand new Tesla Model 3. As a miles & points fanatic, I obviously spent hours thinking of ways to earn the most points for my purchase.

Technically, Tesla wouldn’t accept a credit card payment. But there was an easy workaround that got me the car and more than 180,000 Chase Ultimate Rewards points! These points should get me $5,000+ worth of travel. So buying a Tesla basically paid for my next vacation (or two!).

Purchasing a Tesla Model 3 With a Credit Card Was Surprisingly Easy and Definitely Worth the Effort Because of the Number of Valuable Points I Earned!

Purchasing a Tesla Model 3 With a Credit Card Was Surprisingly Easy and Definitely Worth the Effort Because of the Number of Valuable Points I Earned!

My wife and I plan to share the car because it’s the only vehicle we own. So we didn’t mind splurging on a reliable electric vehicle that should save us in the long-term with no fuel expense. And we were in desperate need of a new vehicle because my wife’s 2006 SUV was falling apart.

Here’s how I purchased a Tesla with a credit card and earned a ton of valuable Chase Ultimate Rewards points!

Using Plastiq to Pay for a TeslaLink: How to Use Plastiq to Pay Bills That Don’t Accept Cards

The trick to using a credit card to pay bills (like a car purchase) that don’t normally accept cards is Plastiq. This convenient service allows you to pay nearly any bill with a Visa, MasterCard or AMEX credit card for a flat 2.5% fee.

I’ve used Plastiq many times to pay rent and other bills because it’s an easy way to meet minimum spending requirements on a new card and unlock lucrative sign-up bonuses on top credit cards! You can check out our step-by-step guide to using Plastiq to pay bills with a credit card.

Note: Plastiq recently announced changes to how certain personal Visa cards and issuers treat Plastiq purchases. You can read more about the important changes here. Certain cards code Plastiq purchases as a cash advance, so you do NOT want to use such cards when paying through Plastiq.

I put a refundable deposit down for the Tesla Model 3 in March 2016 when reservations were first available. Actually, I put a deposit down for 2 cars. And I recently sold the second one on eBay for a healthy profit. My eBay side hustle helps me continue to qualify for small business credit cards!

We were notified last month that our reservation was ready to customize.

It Was a Long Wait (Nearly 2.5 Years!), but We Finally Took Delivery of Our Tesla Model 3 Last Week! And Earned a Ton of Valuable Chase Points by Making This Purchase!

It Was a Long Wait (Nearly 2.5 Years!), but We Finally Took Delivery of Our Tesla Model 3 Last Week! And Earned a Ton of Valuable Chase Points by Making This Purchase!

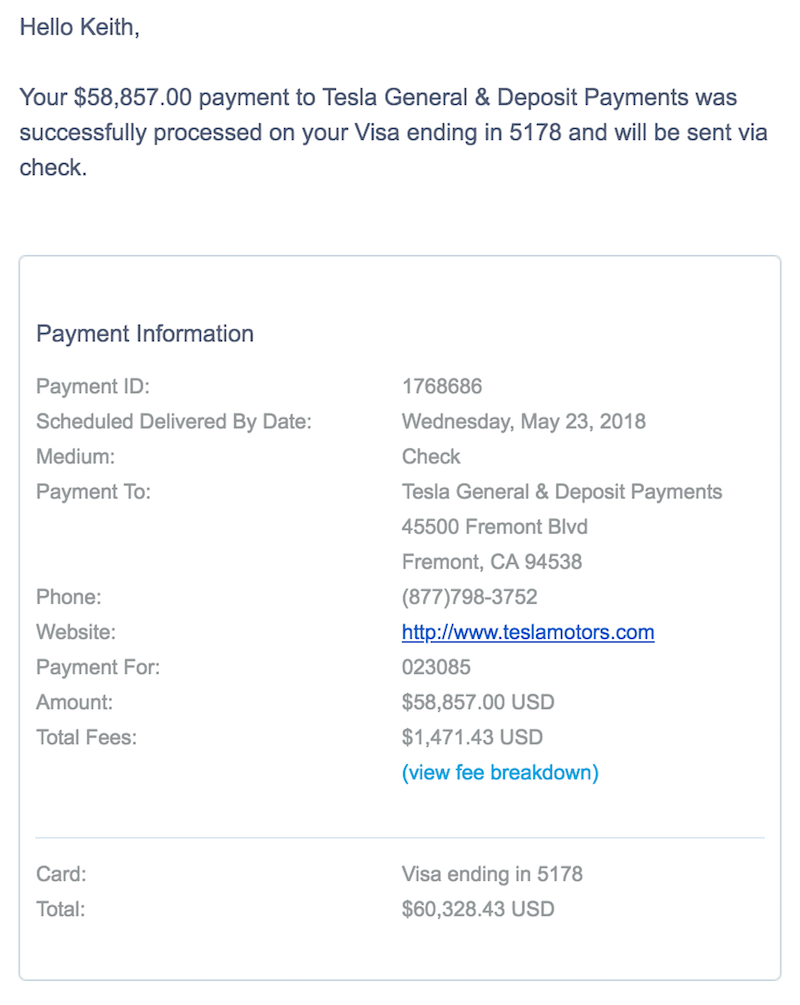

After selecting our preferences for the vehicle, we owed $58,857. This amount included the taxes & fees, which really add up in California. Thankfully, I’ll get $10,000+ back because of various tax incentives offered to folks who buy an electric vehicle.

Thanks to Plastiq, I Was Able to Pay the Remaining Balance for Our Tesla Purchase

Thanks to Plastiq, I Was Able to Pay the Remaining Balance for Our Tesla Purchase

At first, I was unsure if the purchase would go through on my card because I only had a ~$37,000 credit limit. But I used a Visa Signature card, which allows you to spend above your credit limit. Unfortunately, there’s no way to check how much you can spend above your limit, but this is a great feature that I didn’t know about before. In my case, I was able to make a purchase that was ~$23,000 above the limit on my card.

The fee to use Plastiq for my car payment was ~$1,471. Paying this fee was a no-brainer because…

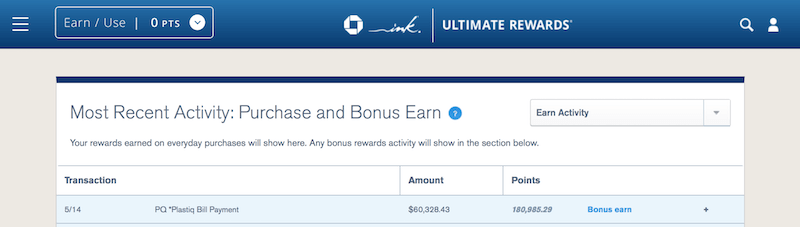

Plastiq Payments Earn 3X Chase Ultimate Rewards Points With the Ink Business Preferred!From experience, I know that using the Ink Business Preferred℠ Credit Card for payments through Plastiq earns 3X Chase Ultimate Rewards points! This means my ~$60,000 purchase earned me more than 180,000 Chase Ultimate Rewards points! I plan to use the car for business travel, so I didn’t have any reservations about using a small business credit card for the purchase.

Plastiq Payments Earn 3X Chase Ultimate Rewards Points With the Ink Business Preferred!

Plastiq Payments Earn 3X Chase Ultimate Rewards Points With the Ink Business Preferred!

Note: While Plastiq purchases have earned 3X points in the past, there’s no guarantee this will happen in the future. So I’d only recommend this strategy if you’re comfortable not earning every last bonus point. For example, if I only earned 1 point per $1 with the Tesla purchase, I still would have used Plastiq. Because I get a lot of value from Chase Ultimate Rewards points! Some points are better than none at all!

At a minimum, 180,000 Chase Ultimate Rewards points are worth $1,800 in cash back. So I earned a “profit” of ~$329 when taking into account the $1,471 Plastiq fee ($1,800 in cash back – $1,471 Plastiq fee).

But Chase Ultimate Rewards points are even more valuable for travel redemptions! In the past, my wife and I used Chase Ultimate Rewards points to get 6 Business Class award seats (worth ~$45,000) on a flight home from Australia. And they helped us save thousands of dollars on our around-the-world honeymoon.

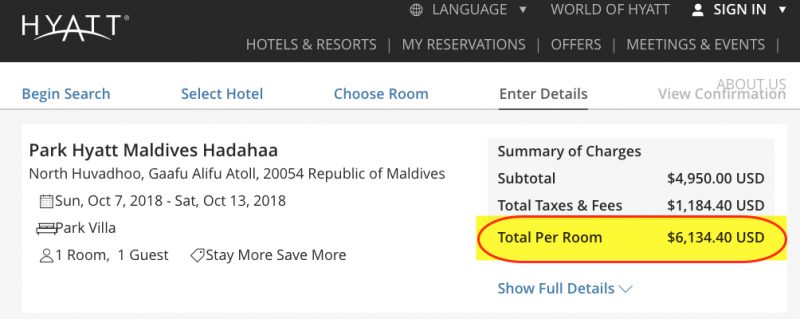

With the 180,000 Chase Ultimate Rewards points I earned from the Tesla purchase, I think I’ll get at least $5,000 worth of travel. For example, I can transfer these points to Hyatt at 1:1 ratio to book free nights at top-rated hotels like the Park Hyatt Maldives. A free night at this hotel costs 25,000 Hyatt points. So 180,000 points is more than enough for 7 free nights!

The Maldives Is on My Bucket List! You Can Transfer Chase Ultimate Rewards Points to Hyatt to Stay Free at the Park Hyatt Maldives!

The Maldives Is on My Bucket List! You Can Transfer Chase Ultimate Rewards Points to Hyatt to Stay Free at the Park Hyatt Maldives!

Paying cash for a sample 7-night stay I looked at in October 2018 would cost more than $6,100!

Using the Points I Earned From Our Tesla Purchase Could Get Me a 7-Night Stay in the Maldives Worth More Than $6,100!

Using the Points I Earned From Our Tesla Purchase Could Get Me a 7-Night Stay in the Maldives Worth More Than $6,100!

Or I’d consider using the points to visit Australia. I’m hoping to make it back in November for a birthday trip! And the points would really come in handy so save money on flights!

For example, I could transfer 160,000 Chase Ultimate Rewards points to United Airlines to book a round-trip Business Class award flight. This same round-trip ticket sells for nearly $7,400!

I Could Use a Portion of the Points I Earned From the Car Purchase to Book a Round-Trip Business Class Award Flight to Australia!

Only Follow This Strategy If You Plan to Pay Off a Large Purchase in Full!

I Could Use a Portion of the Points I Earned From the Car Purchase to Book a Round-Trip Business Class Award Flight to Australia!

Only Follow This Strategy If You Plan to Pay Off a Large Purchase in Full!

My wife and I had money set aside for the Tesla purchase. And as soon as the Plastiq charge hit my credit card statement, I paid it off in full.

If you make a large purchase with a rewards credit card, you’ll want to pay it off right away. Because paying interest & fees by carrying a credit card balance will offset the value of any rewards you earn! We talk about this in our post: 5 Dangers of Applying for Credit Cards.

That said, if you use credit cards responsibly, making a large purchase to earn tons of points is an easy win!

Ink Business Preferred 80,000-Point OfferLink: Apply for the Chase Ink Business Preferred

Link: Our Review of the Chase Ink Business Preferred

When you open the Chase Ink Business Preferred card, you’ll earn 80,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months from account opening. I took advantage of this offer when the card first launched and the points from the sign-up bonus got me a Business Class award flight to New Zealand!

The Ink Business Preferred Sign-Up Bonus Is the Largest Available for Any Chase Ultimate Rewards Point Earning Credit Card!

The Ink Business Preferred Sign-Up Bonus Is the Largest Available for Any Chase Ultimate Rewards Point Earning Credit Card!

As a cardholder, you’ll also get:

3X Chase Ultimate Rewards points for every $1 you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year) 1X Chase Ultimate Rewards points on all other purchases Up to $600 in cell phone insurance when you pay your cell phone bill with the card 25% bonus when you redeem points through the Chase Ultimate Rewards travel portal Primary auto rental insurance (CDW) when renting for business purposes, plus purchase and extended warranty protectionThe card has a $95 annual fee, which is NOT waived the first year. That said, I think the cell phone insurance perk alone is reason enough to keep paying the annual fee. For example, I filed a claim when my Apple iPhone screen shattered. Having coverage with this card helped offset the out-of-pocket cost for the repair.

Keep in mind, the Ink Business Preferred card is impacted by Chase’s tighter application rules. So it’s unlikely you’ll be approved for this card if you’ve opened 5 or more credit card accounts (from any bank) in the past 24 months (NOT counting Chase business cards and these other business cards).

Bottom LineMy wife and I were ecstatic to buy a brand new Tesla Model 3 to replace her 12+ year old SUV. I was even more thrilled that I figured out a way to use a credit card to make the ~$60,000 purchase!

Using the Chase Ink Business Preferred to pay through Plastiq earned me 3X Chase Ultimate Rewards points. This means I earned more than 180,000 Chase Ultimate Rewards points buying the new car!

It was totally worth paying the Plastiq convenience fee because the value of the rewards I earned will get me $5,000 or more worth of travel!

Have you ever made a large purchase with a credit card? Let me know the strategy you used to earn lots of miles or points!