Chase United Business Card review – Monster 100,000 mile bonus that’ll take you almost anywhere

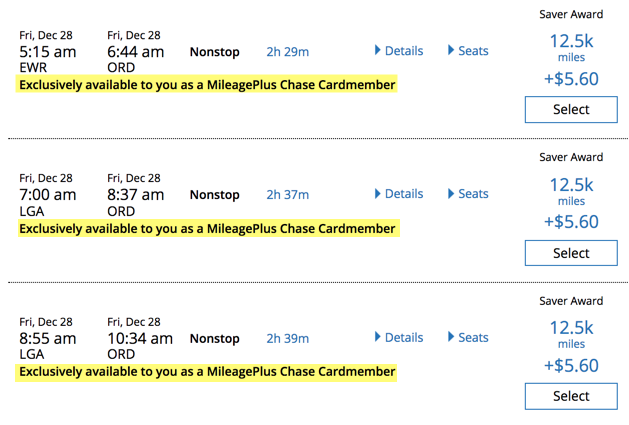

INSIDER SECRET: If you have a United Explorer credit card, you’ll receive access to more available award seats than people without the card.

The United℠ Explorer Business Card is one of the best companions a United flyer can have. You’ll get benefits like free checked bags (which can save up to $120 per round-trip), priority boarding (you’ll always board with plenty of overhead bin space), two single-use United Airlines airport lounge passes annually, and lots more. Oh yeah, and you can earn a six-figure sign-up bonus after meeting tiered minimum spending requirements.

In this review, I’ll show you how to reach anywhere but Antarctica with its bonus — and I’ll expound on the card’s great benefits.

Chase United Business Card bonus

When you open the United Explorer Business Card, you can earn up to 100,000 United Airlines miles:

- 50,000 bonus United Airlines miles after spending $5,000 on purchases within first three months of account opening

- 50,000 more bonus United Airlines miles after spending $25,000 total on purchases within first six months of account opening

Even if you can’t hit that $25,000 threshold, earning 50,000 miles for spending $5,000 is a very respectable bonus. That’s enough for two round-trip flights to anywhere within the US or Canada (and four round-trip flights if you do earn 100,000 miles).

We’ll examine some fun things you can do with this card’s bonus later on, including amazing overseas vacations.

Benefits and perks of the United Explorer Business Card

Here’s the United Explorer Business Card‘s moneymaker. If this collection of benefits doesn’t appeal to you, you probably won’t keep this card long term.

A free checked bag for you and a companion

This can be huge.

When you use your United Explorer Business Card to purchase a ticket (or pay the taxes and fees on your award ticket), and add your loyalty program number, you and one companion will get your first checked bags free (United Airlines operated flights only). United Airlines charges $30 each way for checked bags, so if you’re in the habit of checking a bag, you’ll save $60 per round-trip flight, or up to $120 round-trip if you’re traveling with a partner.

Considering the card’s annual fee is $95, it’s worth opening if you and a partner plan to check a bag with United Airlines this year.

Extra (hidden) award seats

This perk isn’t even fair to folks who don’t have the card.

Anyone who holds an eligible United Airlines credit card will have access to more award seats than those without the card. In other words, if you don’t have the card, seats may look sold out online, but card members have plenty to choose from.

Priority boarding

With Priority Boarding, you’ll still be far from the first passenger aboard the plane. But you’ll also be far from the last. That’ll give you ample time to find overhead bin space for your carry-on.

The best part of this benefit is that it allows you to book United Airlines Basic Economy tickets without losing too many freedoms. For example, with Basic Economy, you aren’t allowed a carry-on. But if you book the fare with the United Explorer Business Card, you are.

Also, Basic Economy means you’re absolutely dead last to board the plane.

Indy boarding his United Airlines Basic Economy flight

If you use your United card to purchase the ticket, you’ll still get priority boarding. The only effects you’ll feel of Basic Economy is that you won’t be able to choose your seat or make any changes to your ticket.

If you don’t have a United Airlines credit card, you should stay away from Basic Economy and just book the incrementally pricier coach fare. If you do have a United Airlines card, the ability to book Basic Economy with little repercussions can add up over time.

Two United Club Passes annually

Every year when you renew your United Explorer Business Card, you’ll get two United Club Lounge one-time passes.

These regularly cost $59 each, (though I’d never actually pay that amount), and they’re a nice refuge from the airport terminal, where you’ll find tons of electrical outlets, snacks and usually free alcohol. United Airlines has some pretty cool lounges in their hub airports, too, like San Francisco and Chicago.

Note: Beginning November 1, 2019, you must be flying United Airlines or a partner airline to use your one-time pass.

Primary rental car insurance

When renting a car for business purposes, you’ll receive primary rental car insurance for most car rentals under 31 days when you charge the entire amount of the rental to your United Explorer Business Card, but you must waive the rental agency’s insurance. This means you won’t have to alert your personal insurance company when you scratch or dent your car. Chase will take care of it!

Many rental car agencies will charge $15+ per day for their in-house insurance, so this can save you a bundle if you rent cars often.

Trip delay insurance

When your travel is delayed 12+ hours or requires an overnight stay, you and your family are covered for things like meals and accommodation, up to $500 per person.

Baggage delay insurance

When your bag is delayed six or more hours, you’ll receive $100 for reasonable expenses, like clothes and toiletries. You’re eligible to receive $100 per day for up to three days (a total compensation of up to $300).

Lost luggage reimbursement

If you or an immediate family member has checked or carry-on bags that become lost or damaged by the carrier, you can be reimbursed up to $3,000 per passenger.

Trip cancellation and interruption insurance

If sickness, severe weather or other eligible situations cut your trip short, you may be reimbursed up to $10,000 per trip for your pre-paid, non-refundable travel expenses, such as:

- Airfare

- Tours

- Hotels

Purchase protection

New purchases made to your card are covered for 120 days against damage or theft, up to $10,000 per claim and $50,000 per year.

Extended warranty

You’ll receive an extra year of coverage on manufacturer warranties that last three years or less.

Is the United Explorer Business Card worth it?

Yes! If you fly United Airlines more than a couple times per year, the United Explorer Business card is fantastic. Remember, you’ll save $30 each way when checking a bag. Two trips with your partner and you’ve already saved $120. And on a related note, you’re able to book the cheapest fares (Basic Economy) without having too different an experience than a regular coach passenger.

Also, if you don’t have another card with travel insurance, this card is a boon. Baggage delays happen (I’ve been reimbursed hundreds of dollars from Chase for this exact reason), and you’re unfortunately bound to receive reimbursement for your misfortune sooner or later.

There’s a $95 annual fee with this card, and it’s worth it for at least the first year to see if the card’s ongoing perks will save you money. Not all of us on the MMS team have this card, but the ones that do have kept it because we save way more than we spend on the annual fee.

One important note is that if you’ve opened five or more cards from any bank (not counting Chase business cards and other business cards) in the past 24 months, you won’t be approved.

How to earn miles with the United Explorer Business Card

With the United Explorer Business Card, you’ll earn:

- 2 United Airlines miles per dollar you spend on purchases from United Airlines

- 2 United Airlines miles per dollar spent at restaurants, gas stations, and office supply stores

- 1 United Airlines mile per dollar you spend on everything else

Those are decent earnings for an airline credit card. Many other cards have an equal or greater earning rate for those purchases, though.

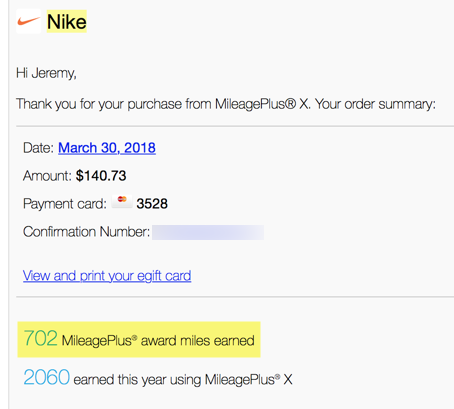

It’s worth mentioning the value of the MileagePlus X app paired with this card, though. The MileagePlus X app is a portal that gives you extra miles for purchases you’d make anyway via dining, online shopping, purchasing gift cards, etc.

The power of the United Explorer Business Card comes from its benefits, not its earning rate.

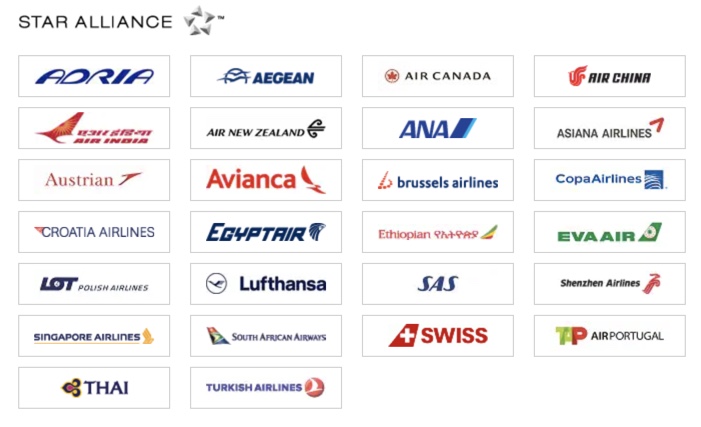

It’s true, United Airlines is ridding themselves of an award chart on November 15, 2019. However, you can still use United Airlines miles to fly many more airlines than just United Airlines. The prices for partner awards, like Turkish Airlines, SWISS, Lufthansa and 20+ more airlines are staying the same. And you won’t have to pay gigantic fuel surcharges, either.

You can read this post to learn exactly how to book United Airlines award flights on the United Airlines website. Before you know it, you’ll be jetting off to a bucket-list destination you never thought would materialize.

Further reading: how to use United Airlines miles

Here are a few fun things you can do with 100,000 United Airlines miles:

- Round-trip coach award flight to Europe (60,000 miles)

- Two round-trip coach award flights to Hawaii (90,000 miles)

- Round-trip coach flight to Australia or New Zealand (80,000 miles)

- Two round-trip coach award flights to Peru (80,000 miles)

Does the United Explorer Business Card charge foreign transaction tees?

No.

United Explorer Business Card Customer Service

This is a Chase card, so you know you’ll receive exceptional customer service when you need it. When you call Chase, you’ll always be greeted by an agent instead of an automated menu. That in itself is a world of difference from other card issuers.

Cards similar to the United Explorer Business Card

United flyers can consider the personal version of this card. It’s got many of the same benefits (like free checked bags and access to more award seats), and you don’t need a for-profit venture to qualify. Currently, the United Explorer Card comes with 40,000 United Airlines miles after spending $2,000 on purchases within the first three months of opening your account.

Or, if your primary motivation for getting the card is United Airlines miles, consider a card that earns Chase Ultimate Rewards points, which transfer to United Airlines. Our top pick is the Chase Sapphire Preferred Card.

Bottom line

The United Explorer Business Card comes with up to 100,000 United Airlines miles after meeting tiered spending requirements:

- 50,000 bonus United Airlines miles after spending $5,000 on purchases within first three months of account opening

- 50,000 more bonus United Airlines miles after spending $25,000 total on purchases within first six months of account opening

United Airlines miles are easy to use, because you can redeem them for flights on 25+ partner airlines to reach every corner of the world! The card also has exceptional perks for United Airlines flyers, like free checked bags, priority boarding, primary rental car insurance when renting for business purposes, and lots more. To learn more about United Airlines miles, check out our guides:

- United Mileage Plus review

- United Miles value

- United Airlines status review

- Do United Airlines Miles Expire?

For the latest tips and tricks on traveling on the cheap without sacrificing quality of life, please subscribe to the Million Mile Secrets daily email newsletter.