How to earn Amex Membership Rewards points

One of the best, most flexible rewards programs is American Express Membership Rewards. It’s no wonder that a number cards that earn Membership Rewards points top our list of the best Amex cards and the best credit cards for travel. You can use American Express points to book travel through the Amex Travel Portal or you can transfer your points to airline and hotel partners like Marriott, Delta, and British Airways.

We’ll show you all the ways you can earn Amex points.

How to earn American Express Membership Rewards points

The quickest way to give your Amex Membership Rewards points balance a big boost is with credit card welcome offers and bonus categories. (There are other ways you can earn even more Membership Rewards points which we’ll go through below.)

Earn the welcome offers on these cards

There are several Amex cards that earn Amex Membership Rewards points, including personal and small-business cards. We’ll break down each card for you to see which are the best fit for your spending habits.

The Platinum Card® from American Express

One of the best premium travel cards is the Platinum Card® from American Express. When you apply for the Amex Platinum card, you’ll earn 60,000 Amex Membership Rewards points after spending $5,000 on purchases in the first three months of account opening.

With the Amex Platinum, you’ll also earn:

- 5x Amex Membership Rewards points per $1 spent on airfare (booked either directly with the airline or through Amex Travel)

- 5x Amex Membership Rewards points per $1 spent on prepaid hotels on booked on amextravel.com.

- 1x Amex Membership Rewards point per $1 spend on eligible purchases.

- Terms apply

The Amex Platinum comes with some great benefits, including:

-

- Up to $200 in statement credits per calendar year for incidentals with your selected airline (luggage fees, inflight food and drink, etc.)

- Up to $200 in Uber credit per year

- Priority Pass Select membership and access to Centurion Lounges, as well as access to Delta Sky Club Lounges when flying Delta

- Up to $100 credit for Saks Fifth Avenue

- Statement credit every four years after you apply for Global Entry ($100) or TSA PreCheck ($85)

- Terms apply

The $550 annual fee is not waived the first year (See Rates & Fees) but the credits you get with the card can make up for much of the annual fee. Here’s our full review of the Amex Platinum card.

American Express® Gold Card

One of my favorite cards right now is the American Express® Gold Card. With the Amex Gold you’ll earn 35,000 Amex Membership Rewards points after spending $4,000 on purchases in the first three months of account opening.

The reason I love this card and why I’m really starting to build up my Amex Membership Rewards points is the new bonus categories Amex has introduced. You’ll earn:

- 4x Amex Membership Rewards points at restaurants

- 4x Amex Membership Rewards points at U.S. supermarkets, on up to $25,000 per calendar year in purchases (then 1x)

- 3x Amex Membership Rewards points on flights booked directly with airlines or on Amextravel.com

- Terms apply

My wife and I spend ~$150 per week at grocery stores. That means we’ll earn ~31,000 Amex Membership Rewards points per year on our grocery spending. Add in $100 a week at restaurants, and there’s another 20,000 Amex Membership Rewards points. That’s 50,000+ points per year. If you know how much you typically spend in these categories, multiply that number by four to see how many points you’ll earn every year.

In addition to the great points-earning ability with this card, you’ll also get:

- Dining credit of up to $120 ($10 monthly) spent each year at participating restaurants (enrollment required)

- Up to $100 in airline incidental-fee credit each calendar year on your selected airline

- No foreign transaction fees (See Rates & Fees)

- Terms apply

The annual fee is $250 (See Rates & Fees), but new bonus categories, the dining credit of up to $120 and a $100 credit for airline incidentals pretty much negate the annual fee.

Here’s our review of the American Express Gold Card.

The Business Platinum® Card from American Express

The Business Platinum® Card from American Express is similar to the personal version but it has a few differences. With the Amex Business Platinum, you’ll earn up to 75,000 points after meeting tiered spending requirements — 50,000 points after you spend $10,000 and an extra 25,000 points after you spend an additional $10,000 all on qualifying purchases made on the card within the first three months of account opening.

Earning with this card can very lucrative for small businesses with the bonus categories below:

- 1.5x Amex Membership Rewards points on single purchases of $5,000+ (up to 1 million additional points per calendar year)

- 5x Amex Membership Rewards points when you book airfare and hotels through the Amex travel portal

- 1x Amex Membership Rewards point per $1 on everything else

- Terms apply

The Amex Business Platinum also comes with these perks:

- 35% of your points back for all first-class or business-class flights booked through the Amex travel portal using Pay With Points

- 35% of your points back for all flights, including coach tickets, booked with your selected airline through the Amex travel portal using Pay With Points (up to 500,000 points per calendar year)

- Up to $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, inflight food and drink, etc.)

- Priority Pass Select membership and access to Centurion Lounges, as well as access to Delta Sky Club Lounges when flying Delta

- 10 free Gogo inflight Wi-Fi passes each calendar year

- Statement credit every four years after you apply for Global Entry ($100) or TSA PreCheck ($85)

- Terms apply

This is a great for small businesses looking to quickly build the Amex Membership Rewards balance and the benefits and perks can easily offset the $595 annual fee (See Rates & Fees).

You can read our in-depth review of the Amex Business Platinum card here.

American Express® Business Gold Card

You can earn 35,000 Membership Rewards® points after you spend $5,000 on eligible purchases with the Business Gold Card within the first three months of cardmembership.

And you will earn 4 Amex Membership Rewards points in two categories where you spend the most each month (capped at the first $150,000 in combined purchases each calendar year, then 1 point per $1).

You can chose from these six bonus categories:

- Airfare purchased directly from airlines

- U.S. purchases for advertising in select media (online, TV, radio)

- U.S. purchases made directly from select providers of computer hardware, software, and cloud solutions

- U.S. purchases at gas stations

- U.S. purchases at restaurants

- U.S. purchases for shipping

The Amex Business Gold Card comes with a $295 annual fee (See Rates & Fees). Here’s our review of the Amex Business Gold Card.

American Express EveryDay® Preferred Credit Card

With the Amex EveryDay® Preferred Credit Card, you’ll earn 15,000 American Express Membership Rewards points after spending $1,000 on purchases with your new card in the first three months. That’s a nice way to earn Amex Membership Rewards points with a small spending requirement.

The card also has a few bonus categories to earn Amex Membership points, including:

- 3x points at U.S. supermarkets, on up to $6,000 per year in purchases, then 1x points

- 2x points at U.S. gas stations

- 1x points on other purchases

- Terms apply

Amex also offers a frequent transaction bonus on this card. If you make 30 or more purchases in one billing cycle, you’ll receive 50% more points. That means you’ll earn 4.5x points at supermarkets, 3x points at gas stations, and 1.5x on everything else.

The information for the Amex EveryDay® Preferred Credit Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

The Blue Business®️ Plus Credit Card from American Express

The Amex Blue Business Plus Credit Card does not currently have a welcome offer. However, it also does not have an annual fee (See Rates & Fees). It will boost your Amex Membership Rewards balance because you will earn 2 Amex Membership Rewards points per $1 on the first $50,000 in purchases per year (1x Amex Membership Rewards point per $1 on all purchases after that).

Earning 2x points for every $1 spent with no annual fee is a great deal and makes this a good card for any small-business owner who is looking to earn Amex Membership Rewards points on daily spending that doesn’t count toward any Amex bonus categories.

You’ll find our review of the Blue Business Plus Credit Card from American Express here.

Business Green Rewards Card From American Express

You’ve probably noticed the Amex Business Green Rewards Card — its design is iconic. With this card, you’ll earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases in the first three months of cardmembership.

You’ll earn 2 points per $1 on eligible purchases made when you book on the American Express Travel website and 1 point per $1 on all other eligible purchases. The earning potential isn’t great with this card and it comes with a $95 annual fee (that’s waived for the first year). (See Rates & Fees).

Earn extra Amex Membership Rewards points with Amex Offers

Amex Offers can save you lots of money on purchases you were going to make anyway. Amex cardholders are targeted for certain offers, which you need to activate in order to take advantage of the extra points or cash back when you make a qualifying purchase.

Amex Offers come in several forms. You can earn additional Membership Rewards Points at certain retailers or a set bonus when spending a minimum amount at a retailer. For example, the offer could be: “Get one additional Membership Rewards point for each $1 you spend” at a certain store until the expiration date.

The other type of Amex Offer you might see would say something like, “Spend $350, get 6,000 Membership Rewards Points” which means you’ll earn a 6,000-point bonus once you meet the minimum spend requirement. You can really start to rack up the Membership Rewards points when using Amex Offers.

Keep in mind that the bonus points or statement credits you receive from Amex Offers are applied after your purchase. So you can take advantage of any other money-saving tactics without worrying that they won’t combine with Amex Offers. You can use shopping portals, promotional codes, coupons, and more.

Refer a friend and earn a bonus

American Express lets you send referrals for cards to friends and family. When your friends are approved, you earn Membership Rewards points.

Even better, you don’t have to refer a friend to the exact Amex card you have. If you have the Amex Platinum, for example, but your friend wants the Hilton Honors Aspire Card from American Express, you can refer them to that card and still get a referral bonus.

The only catch is that if you’re a personal Amex cardholder, you can only earn referral bonuses for personal cards. The same goes for business cards.

You can find your referral links when you log into your Amex account, just after your card’s balance and payment information.

Add an authorized user to your Amex card

On occasion, Amex will offer bonus Amex Membership Rewards points for adding authorized users to your account.

The only downside to this is that, depending on which card you’re adding the authorized user to, there could be an extra charge. Plus, it could affect the authorized user’s ability to get approved for Chase cards given the Chase 5/24 rule.

Shop through the Rakuten shopping portal

Online shopping portals are an easy way to earn lots of bonus travel rewards or cash back on purchases you’re probably making anyway. When you shop through a portal you’re able to double-dip rewards, because you’ll get the rewards from the card you’re using (hopefully one of the best credit cards for travel) along with whatever rewards or cash back you earn through that particular portal.

In order to earn Amex Membership Rewards points through Rakuten, you’ll need to link a card that earns Amex Membership Rewards, like The Platinum Card® from American Express or the American Express® Business Gold Card, to your Rakuten account and change your Rakuten account settings so you can earn Membership Rewards points as your payout.

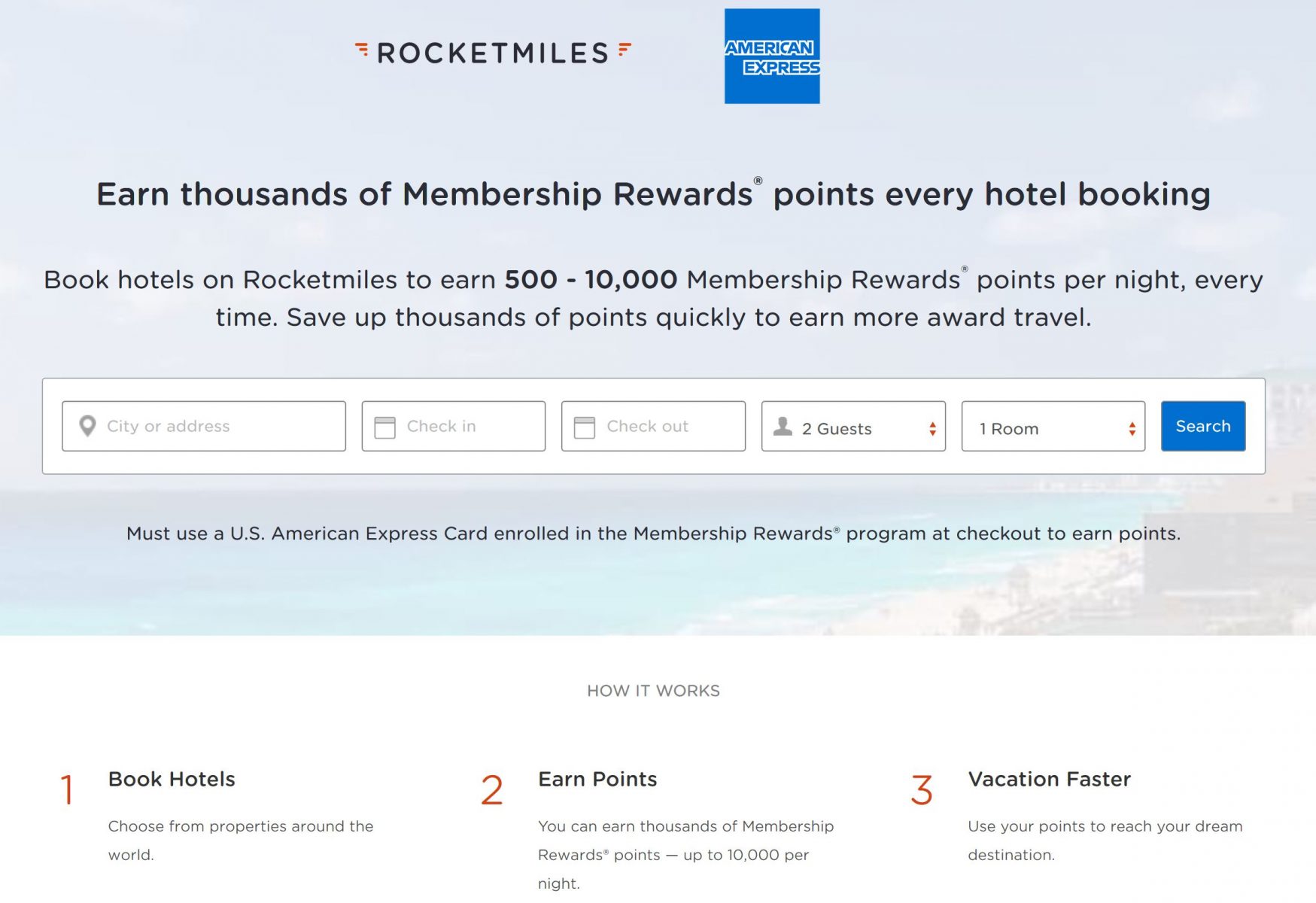

Book hotel stays with Rocketmiles

Amex and Rocketmiles have recently teamed up to offer Amex Membership Rewards cardholders 500 to 10,000 Amex Membership Rewards points per night when they book hotels on Rocketmiles.com. You’ll need to use an American Express card enrolled in the Membership Rewards program at checkout to earn points.

I did a quick search for hotels and found that I could book a $275 hotel stay at the Hyatt Regency in San Fransisco this month and I’d earn 6,000 Amex Membership Rewards points. That’s an earning rate of ~22x Membership Rewards points per $1! However, I was also able to find this hotel cheaper at other websites, so you definitely want to do your research before booking.

If the price is similar, booking through Rocketmiles would earn you lots of Amex Rewards Points. This is an interesting new partnership that I’m excited to explore.

Enroll in extended pay

If you have an Amex charge card like the Amex Gold Card, Amex sometimes sends out targeted offers to earn either 5,000 or 10,000 Amex Membership Rewards points by enrolling in Amex Extended Pay.

Normally, you’re required to pay your full charge card balance every month and if you don’t, there are substantial penalties. But Amex Extended Pay allows you to carry a balance if you meet certain conditions.

These offers are sent by snail mail and email so be on the lookout. This can be a great way to earn some extra bonus points on purchases you’ve already made.

You can read more about how team member Meghan earned 10,000 Amex Membership Rewards points by enrolling in Amex Extended Pay.

Bottom line

There are a lot of ways to earn Amex Membership Rewards points. The points are extremely valuable because you can transfer them to any of Amex’s airline and hotel transfer partners. You can also book travel directly through the Amex Travel Portal.

The easiest way to earn lots of Amex Membership Rewards points quickly is by earning the welcome bonus on a card like The Platinum Card® from American Express, American Express® Gold Card, or The Business Platinum® Card from American Express.

But don’t forget to enroll in Amex Offers in order to earn bonus points. Also, use the refer-a-friend program to earn bonus points and give your friends a boost as well.

If you have an American Express card already, do you have any additional tips and tricks you use to boost your point balance? Let us know below.

For rates and fees of the Amex Platinum card, please click here.

For rates and fees of the Amex Gold card, please click here.

For rates and fees of the Amex Business Platinum card, please click here.

For rates and fees of the Amex Business Gold card, please click here.

For rates and fees of the Blue Business Plus card, please click here.

For rates and fees of the Amex Business Green card, please click here.